7 Key Medicare Dates in the New Climate and Health Law

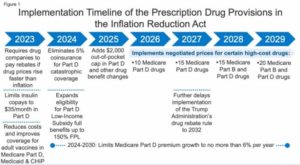

On August 16, 2022, President Biden signed into law the Inflation Reduction Act of 2022, which includes a broad package of health, tax, and climate change provisions. The Law includes several provisions to lower prescription drug costs for people with Medicare and reduce drug spending by the federal government. These provisions will take effect beginning in 2023.

Here’s a look at seven Medicare dates in the new law that could affect advisors’ clients:

December 31, 2022: Medicare Part B Rebatable Drug Price Tracking (Section 11102)

Drugmakers are supposed to pay rebates to the Medicare program if the prices of certain types of drugs provided through the Medicare Part B outpatient and physician services program increases faster than the rate of inflation.

This rule will apply to drugs provided during the 12-month period that starts Oct. 1, 2022, and the U.S. Health and Human Services (HHS) secretary is supposed to provide instructions on how to implement the rebate program early enough for manufacturers to pay any rebates owed for drugs sold during that first 12-month “applicable period”.

This provision could affect clients by helping to hold Medicare Part B premiums down, but it could push drug-makers to try to increase prices for drugs that patients buy using Medicare Part D drug coverage, ordinary commercial coverage, their own cash or other arrangements.

January 1, 2023: Medicare Part D Drug Plan Cost-Sharing for Recommended Adult Vaccines (Section 11401)

Starting Jan. 1, 2023, Medicare Part D drug coverage is supposed to cover recommended adult vaccines without imposing deductibles, co-payment requirements or coinsurance requirements.

The early applicability date for this requirement means Medicare program managers may already be drafting the regulations needed to implement this provision.

January 1, 2023: Medicare Part D Insulin Co-Payment Rules (Section 11406(a))

Starting Jan. 1, 2023, a stand-alone Medicare Part D drug plan or Medicare Advantage plan that provides drug benefits must limit the patient’s co-payment for insulin to $35.

The limit will change to the lesser of $35, 25% of a specified “maximum fair price”, or 25% of a negotiated insulin price starting Jan. 1, 2026.

February 1, 2024: Selected Drug Publication Date for the Medicare Drug Price Negotiation Program (Section 11001)

The Health and Human Services secretary is supposed to begin phasing in price negotiations for some high-priced, single-source drugs in 2026.

To make that work, the HHS secretary is supposed to choose “10 negotiation-eligible drugs” for 2026 and publish their names by the selected drug publication date.

March 1, 2024: Joining a Medicare Part D Drug Manufacturers Discount Program (Section 1860D-14C)

The new law replaces the current coverage gap discount program with a new discount program, aimed at Medicare Part D enrollees who have exhausted ordinary prescription drug benefits and have not yet reached the new $2,000-per-year out-of-pocket drug spending gap.

The new program will start Jan. 1, 2025. To participate in the first year, a manufacturer must enter into an agreement with the Health and Human Services secretary by March 1, 2024.

November 1, 2024: The End of the Selected Drug Negotiation Period for the Medicare Drug Price Negotiation Program (Section 11001)

One sign the new Medicare price negotiation program for some high-priced, single-sourced drugs is on track to influence prices in 2026 is if the Health and Human Services secretary completes price negotiations by Nov. 1, 2024.

2025: The $2,000 Maximum Out-of-Pocket Drug Cap for Medicare Part D Enrollees (Section 11201)

The $2,000 out-of-pocket spending cap will take effect in 2025. Medicare program managers will adjust the cap for inflation in later years.

If you are like me, these future changes are exciting and scarry at the same time. But overall, I believe the Medicare beneficiary will benefit greatly.

-Rick

For more Industry News and Tips and Resources regarding Medicare Supplement,

Reach out to Rick Roberts.